|

||||||||

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp DeCom Markets FOMEZ GPEUN LED - Hubs GOMTX RingLink SODA FEV Economic Engine Smart Contracts UDC DFDC UDI PriceDemand |

||||||||

| GeoCommerce decentralizes economy to economy Commerce | ||||||||

|

||||||||

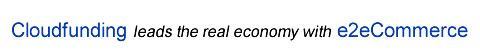

| e2eCommerce seamlessly merges Offline to Online in real time | ||||||||

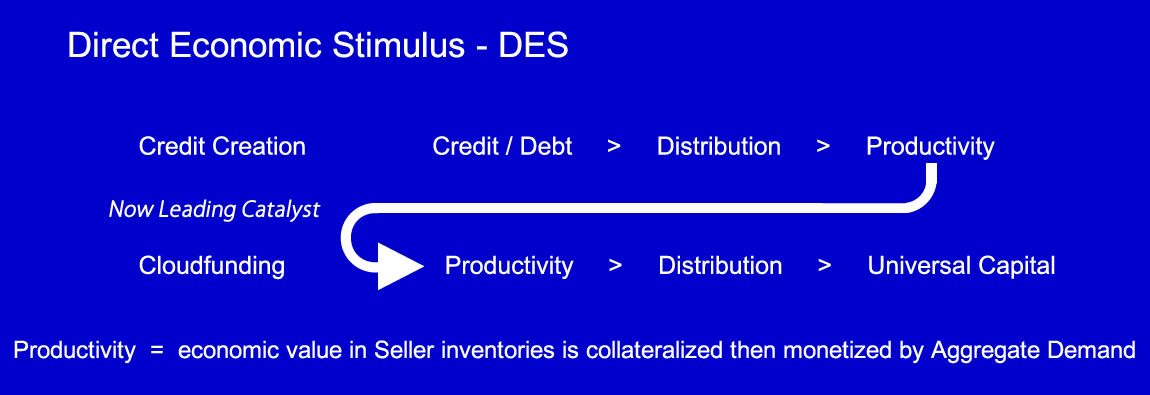

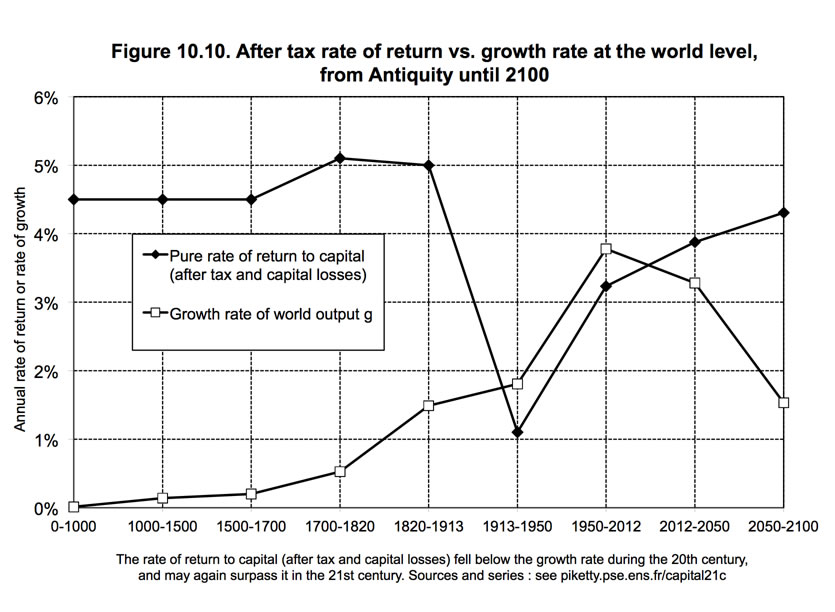

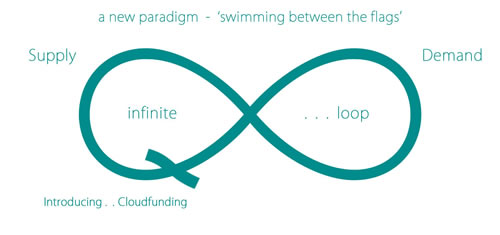

Changing the dynamics brings a new local economic outlook Up until 2008 there was little questioning around the way neoliberalism controlled globalization and how world trade has had credit pushed into industry and societies, all to try and gain economic growth through increased productivity - little attention focused on how it allowed inequality to build in developed countries, diluting the standard of living of the middle class, by heavily indebting the most productive sector of societies, by maximizing them financially and subsequently minimizing their standard of living. The forced indebtedness of society by the financial sector in the name of productivity is more about the reoccurring flaw in the banking industry's ability to create credit from nothing, then linking it to an unproductive asset like real estate, leaving families exposed when the pendulum turns and society is maxed out on debt - it's all linked to stagnant wages and the gap to the rise in productivity, and a similar increase in credit indebtedness with the rise in house prices during the same period, all which push up prices in goods and services. The majority of the middle class are employed by SME across the world, and these businesses are responsible for up to 60% of a country's productivity but it's this SME sector that has been caught in between consumers and lenders, with lenders preferring to take less risk with consumers with jobs than lending to SMEs that risk staying in business. The way the financial system has been structured ( since the 1970s ) sets up the business sector ( mainly SMEs ) as the sacrificial lamb by increasingly marginalizing its position in the business cycle, and ignoring its contribution to the economy - while the financial sector has increasingly been focused on creating credit ( without intrinsic value ) to largely lend out for speculative non-productive asset purchases through real estate, large corporations ( M&As, shareholder dividends and share buy-backs ) and sharemarkets. This lack of appetite by banks to lend out to SMEs provides the run-way for a new form of SME funding that, unlike using rent-seeking as a business model, Cloudfunding is an equity driven market that's controlled by a decentralized global crowd network - it's a paradigm shift from the control held over supply and demand by the financial markets to an independent and autonomous economical market structure that's democratically controlled by global societies. Cloudfunding are the mechanics of GeoCommerce where local Offline and Online businesses converge on a new economic utility network linking consumers across economies ( e2eCommerce ) to produce an efficient and stable growth in productivity by separating the Supply side from the Demand side so that both sellers and buyers can be stimulated into producing economic growth without the reliance of debt - it provides a clear free open market where even if the supply side is influenced by tariffs and subsidies, the demand side becomes the true indicator of the real markets. Reshaping Capitalism so business works better and local economies survive With Capitalism in the last 40 years, it's now evident that the world can't go on accumulating debt and deeper inequality - Geoeconomics on the other hand is equity funded and governed by real productivity ( similar to the way the Gold Standard operated ), which can direct economic stimulus into geographical locations, without any debt overhang, by decentralizing control over the capital flows via a democratic consensus as it moves from economy to economy. With GeoCommerce, there is a democratic consensus operating across borders applying algorithmic economics through a real time balance of payments type process to spread productive wealth, and not disingenuous credit in the form of FDI loans that distort economies - it allows a broad exposure of economies, large and small, to a decentralized global audience that can directly participate in helping to grow economies, without some being sidelined economically by globalization and selfish corporations. Before banks came along to look after society's gold and money and be lenders to businesses and consumers, there was a simple model of money and gold being held by businesses and consumers, and exchanged between themselves with minimal security - so security and the capacity to use the centralized money and gold to expand economic growth through increased lending, mainly to businesses to increase productivity, was the bank's main business model - that original banking model is now fundamentally broken as the banking system no longer sees that lending to businesses, especially SMEs, is profitable enough, or there's too much risk associated with it compared to lending for buying real estate - but today's technology can now go back to that old model before the banks came along, and provide an eco-system that secures the 'idle capacity' ( economic value ) held by businesses by providing the means to exchange with consumers within local economies, directly through commoditizing it as a universal peer to peer exchange of value to facilitate activities - providing a cleaner and much more advantageous system of financing businesses to sustainably grow the businesses and their local economies, while constantly being aligned within a decentralized alliance network of like-minded businesses and consumers across other local economies - it's able to redirect the real time aggregate demand of genuine productivity around the world and re-distribute back into the decentralized market maker network to continually stimulate new productivity across local economies. GeoCommerce helps solve the conundrum facing local economies where the downward trend in seller discounting, looking for demand, is no longer able to maximize profits, while the private sector, as a group, is minimizing debt ( deleveraging ) by limiting their spending - SIA helps open up the supply side and demand side to simultaneously maximize profitability for sellers, and maximize affordability for buyers - it solves the dilemma of diminishing tax returns that constant seller discounting has on local governments by maintaining full selling prices and profits ( selling prices are governed by Global Price Index ). |

||||||||

| . . decentralized local economical markets can take over from centrally controlled financial markets | ||||||||

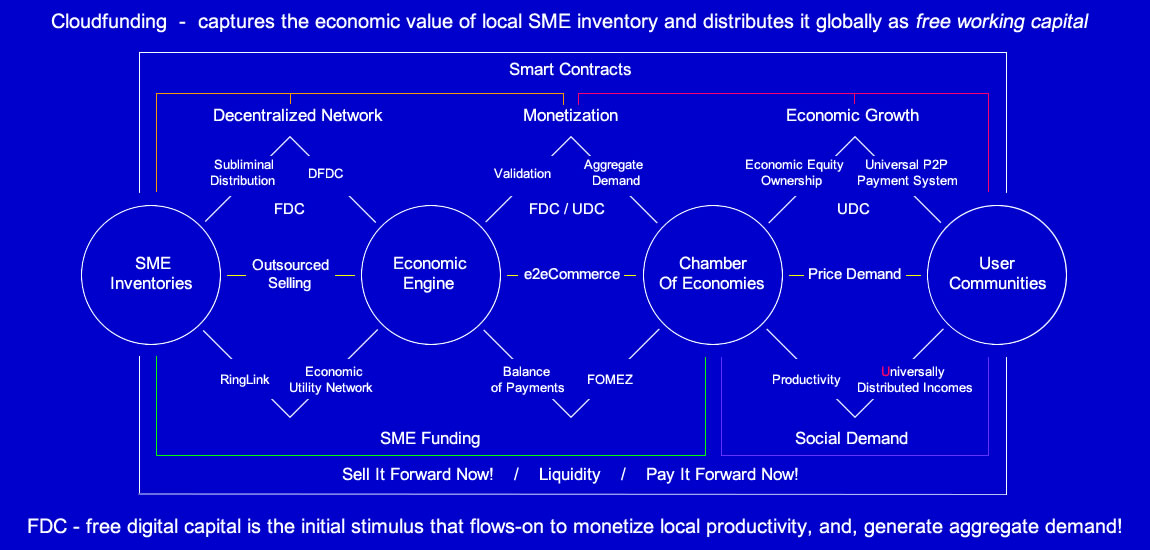

SMEs lead the stimulus just by listing their inventories Direct economic stimulus - DES, is true economic capital, not credit or debt, and it's drawn from the aggregate demand of genuine products and services sold around the world, which is distributed to the global market maker network to drive the supply side of the local markets to achieve real Productivity. GeoCommerce encompasses a number of changes in the mechanics of how Commerce can work better, such as changing the shareholder model by decentralizing the impact from an input of capital and an extraction of a greater volume capital from a business and local economy in the form of shareholder returns on their investment - shifting to one that directs new capital flows into businesses and local economies, and those participating become new economic equity owners holding a stake in the productivity in the local economy, taking in all the other businesses and industries in that local economy, and earn a linear income from the broader productivity volumes in the various local economies - these changes from the rent-seeking system to a direct involvement environment that's able to achieve close to an equilibrium between supply and demand because of the real-time balance of payments and the direct involvement of economic equity owners ( stakeholders ) and global market makers, also avoids the need to have inflation to push up prices so it disguises the shift of capital from the real economy to the financial system players and in turn disguises the dilution of the local economy's money. |

||||||||

| Cloudfunding is DeCom | ||||||||

| " Cloudfunding does for modern economies in tokenizing the local economic value . . as what the invent of coinage did for commerce and trade in ancient times! " |

||||||||

|

||||||||

| " Now, local economic value is universally issued, owned and governed by the people, for the people . . to fully monetize productivity across global commerce and trade! " |

||||||||

| Decentralized Commerce | ||||||||

|

||||||||

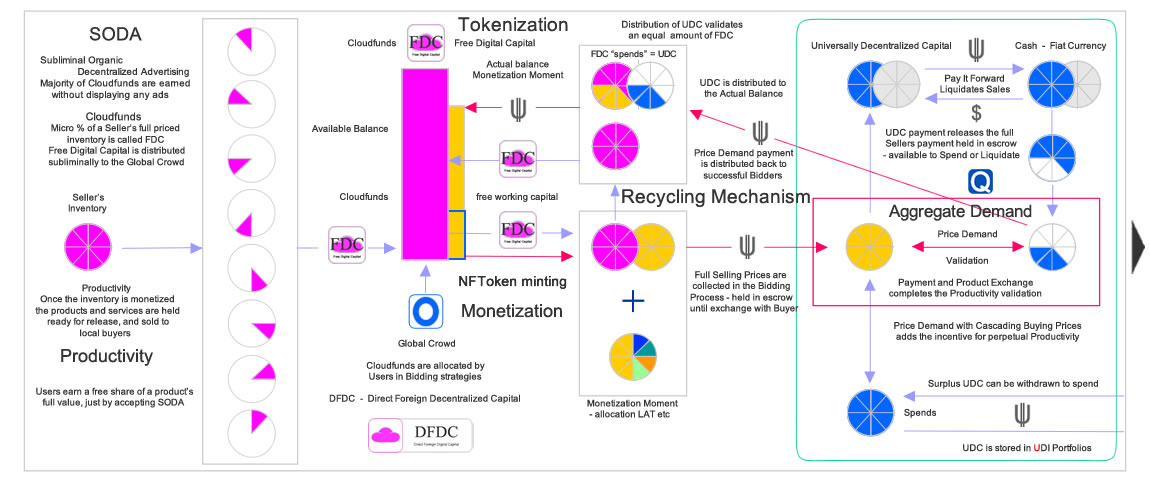

It means sold Productivity is monetizing new Productivity with validated economic capital, which is generated by the real-time Aggregate Demand of the sold products and services, on a global scale - basically flipping the Credit Creation model around to use Productivity as the leading catalyst with debt free capital financing SME inventories ( before selling to local buyers ), and the sellers in-turn distribute new capital flows out into the local economies via their operating costs and wages. The volume of SME inventories waiting to be sold at any one time is greater than all the lending that banks can create at any one time - this gives SMEs a forward position of being the lead catalyst in generating and distributing capital flows across local economies - this infrastructure layout is an autonomous economic ecosystem that's independent to the financial system, giving SMEs the ability to be part of a decentralized economic alliance that operates with a neutral universal capital that's ubiquitous and borderless across the world. It provides the real economy the landscape in which local inventories are able to be validated as equity that governs the volume of capital flowing in local economies, similar to the way the Gold Standard govern old money - this allows SMEs, inside local economies, to be the springboard for local societies to delever themselves away from credit and debt, and start to overcome the increasing trend of inequality through wage stagnation - with Outsourced Selling, SMEs gain full selling prices, while Price Demand gives Consumers greater buying power, and so circulating the increased disposable incomes back through local businesses. Most developed countries have followed a similar trend of wage stagnation |

||||||||

|

||||||||

Allowing inequality to widen as wages stagnated Without the middle class sector there is no economic growth for countries and societies to proper, so there needs to be a deleveraging away from debt for the most productive sector in any economy, regardless of which county - first through pushing women into the workforce in the 1970s, then came longer hours in the 1990s with some workers needing 2 or even 3 jobs, followed by the opening up of credit in the 2000s to cover the increased price increases, so borrowers could maintain their living standards - all the while the extra credit was pushing house prices up and disguising the fact that wages had been flat-lining since the 1970s, resulting in a widening inequality gap for the middle to lower classes |

||||||||

|

||||||||

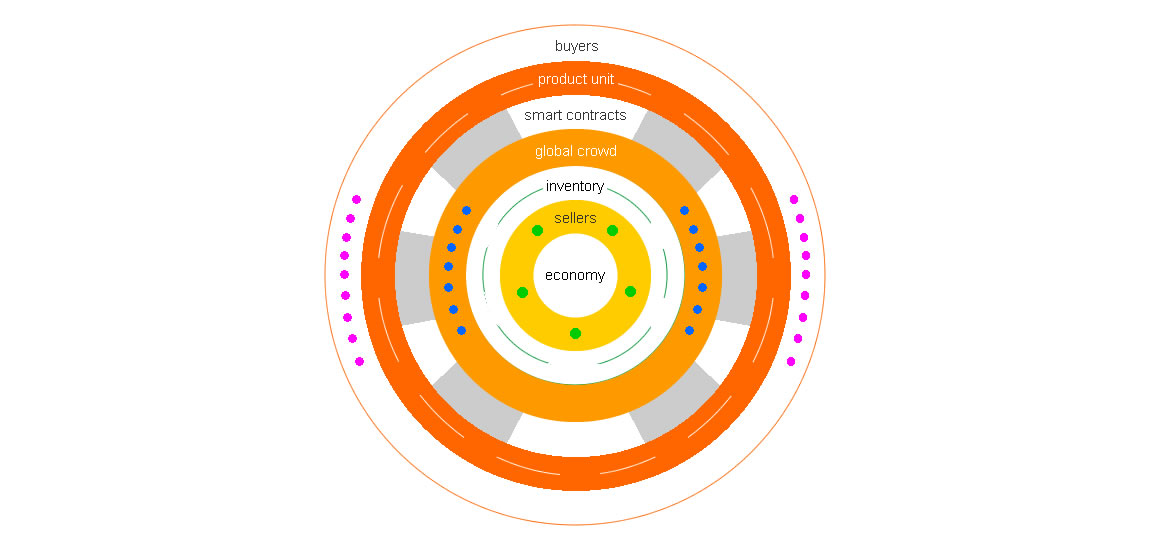

It's a new era Cloudfunding challenges the dynamics in Commerce by giving sellers a competitive advantage with guaranteed and predictable full selling prices - while simultaneously finding the true real time demand by giving buyers greater buying power by giving users the tools to pay prices that they can afford. Cloudfunding gives brick and mortar sellers the opportunity to compete with Online only sellers using the same technology - for both to equally give consumers the chance to buy at prices they want to pay - Cloudfunding separates the Supply side from the Demand side of trade, and gives both sides unprecedented advantages - greatly helped by using deep reaching RingLink technology to globally track the exchange of ownership of assets and value as it moves from peer to peer and across economies. Cloudfunding's architecture includes a new level of participation for the global crowd users to be at the intersection between buyers and sellers and supply and demand - usually it's the small number of traders that have been the middle men that control the flow of trade and capital - but now there's a democratic consensus where the users in the global crowd individually vote to monetize a seller's inventory via a decentralized tracking process. Credit creation borrows from the future, Cloudfunding taps the economic value from real productivity Cloudfunding doesn't create money, it digitally aligns with local currencies already in local economies and perpetually redistributes it using technology that stimulates the flow of economic value in local economies through a decentralized and democratic consensus using Productivity as the leading catalyst - with the end focus of increasing the economic growth in those local economies. Sellers list their inventory to outsource the selling to a global crowd and are guaranteed full selling prices that can be predictable and sustainable - this full monetization of the seller's inventory starts with Subliminal Advertising before there's a final buyer - it's this secure global distribution of value that allows the buyers to buy at prices they want to pay with Price Demand, without it affecting the seller's full selling prices - this shift in supply and demand mechanics via Outsourced Selling and RingLink technology greatly changes the pace and velocity of Commerce and Productivity moving across local economies. Cloudfunding monetizes local economies to new levels of commercial activity Cloudfunding provides all the functions needed for Commerce to work globally between buyers and sellers - the combining of Commerce and Technology creates the ComTechX industry that seamlessly exchanges ownership of value from one economy to another without fees or cross border costs - it eliminates incumbents and allows ubiquitous free peer to peer global trading to be exchanged via a neutral international economic trading unit of account to reconcile assets and liabilities in real time, without any need for local currencies being held or transferred across borders. ComTech encompasses the full spectrum of functions needed in Commerce that monetizes, markets, distributes, tracks ownership, and secures the reconciliation of payment with the exchange products and services from the seller to the buyer at the local level, and across borders on a fully autonomous economic global platform - taking Commerce to a whole new level that maximizes seller revenues which flows on with increased revenue taxes, while giving buyers greater real time buying power - effectively stimulating local economies with increased velocity of local currencies and productivity without risking Capital flight. Balance of Payments in real time |

||||||||

|

||||||||

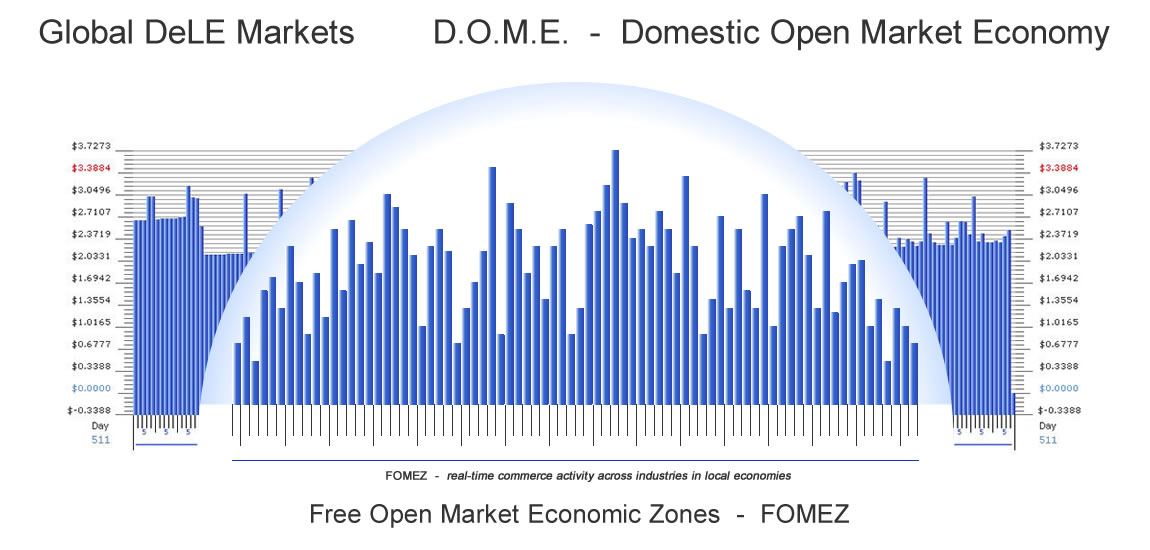

Instead of company shareholders, users are economic equity holders ( stakeholders ) in local economies The economy to economy infrastructure is e2eCommerce, which sits above B2B and B2C businesses and marketplaces - by operating with Cloudfunding, it allows businesses to bypass the incumbents and barriers that have crept into modern commerce, un-leveling the playing field - Cloudfunding gives users tools to generate an infinite commercial trading loop to drive local productivity and organically feed economic growth back into local communities, building the standard of living and help spread economic value across other economies. It means that Cloudfunding's architecture is structured around the 'idle capacity' held in local inventories, and being able to track that economic value moving from economy to economy through the actions of buyers and sellers trading products and services within the supply and demand activity of local economies - the economic value is Capital flowing across the economies and it's constantly compared with the value of local currencies - Cloudfunding uses a neutral universal economic trading value tied to genuine productivity that has a true economic value - trackable in real time to back up the economic flow between economies where the validated economic value is distributed democratically. With e2eCommerce flowing between each Chamber of Economies in the various locations, the trade volume and economic value is tracked in real time on location indices that record the productivity generated by all the commercial activity from industries within every Free Open Market Economic Zone - the productivity in each FOMEZ gains a location activity tax that's collected during the Outsourced Selling process, which is then distributed to global users via a Universally Distributed Income portfolio - this passive form of wealth distribution generates a linear growth that's structured so it can still be influenced by the global users with their pro-active strategies - providing a degree of speculation for competing users, while maintaining the continuity of a positive but never a negative growth. |

||||||||

|

||||||||

| ComTechX the industry, combines Commerce and Technology, bringing together Offline and Online Commerce into the new economy with a streamlined commercial ecosystem . . it operates in an autonomous infrastructure, in the way the internet was intended, with an ubiquitous universal value synchronizing all the global economies to operate as one |

||||||||

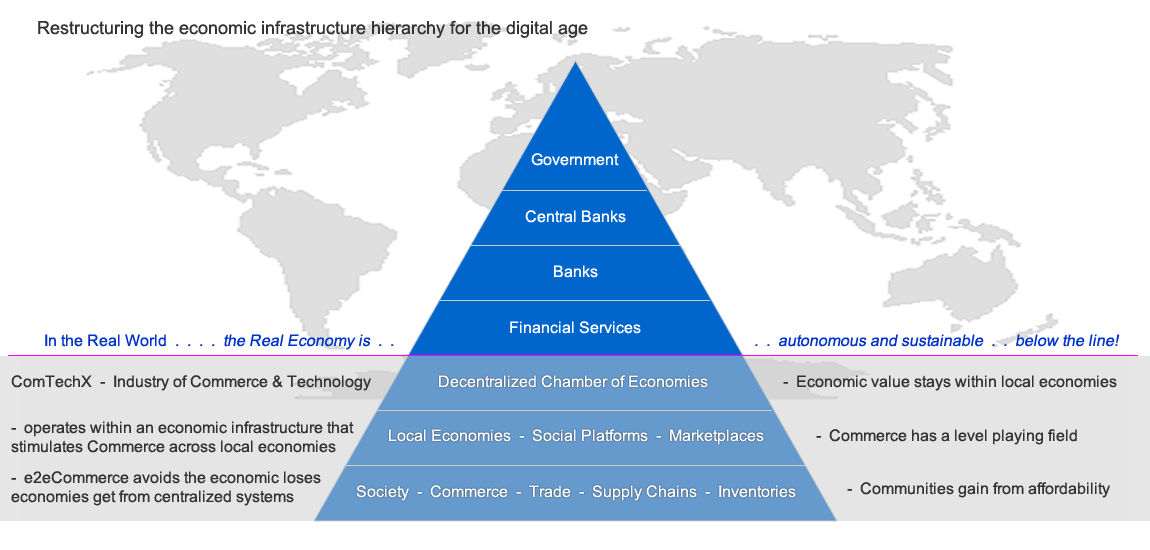

| Economies in most countries have been separated into two separate entities, those below the line produce and add economic value, those above take from that economic value Global Chamber of Economies find a balance by providing local economies with the voice and platform to operate independently and retain the economic wealth that is produced |

||||||||

| Separation of Commerce from the Banking and Financial System in Cloudfunding's economic infrastructure acts similar to how the Glass-Steagall Act operated from 1933 to 1999 . . this was when the retail side of banking was separated from the investment side, which involved speculation on the stock markets and a main cause of the Great Depression |

||||||||

| Local SMEs can change the status quo by outsourcing the selling of their inventory at guaranteed full selling prices to gain a competitive advantage against big box competition Cloudfunding gives SMEs predictable cashflows so they have the confidence to invest in stock and upgrades, which lead to jobs - ingredients for a better local economy |

||||||||

| Cloudfunding expands economies with mechanics that drive private and public expenditure What makes Cloudfunding so suited to the modern era is that instead of following a 300 year old tradition of distributing credit into our society in the hope that it's returned with interest, and that's even before there's any productivity - hence creating a risk managed indebted system that's continually susceptible to booms and busts - Cloudfunding uses deep distribution RingLink technology to fully monetize products and services ready for sale by drawing from a collected economic value from previous productivity - in summary, this means that in Cloudfunding, Productivity leads the distribution of Capital, allowing Capital to flow into communities with no overhanging debt. The shift that the United States of America was able to pull off since the 1970s until now, from a being surplus to a deficit economy that relied on recycled surplus profits made by trading partners and reinvesting it back into the USA, is now able to be digitized on a global scale - but by bypassing the incumbents and making local economies the benefactors of stabilized Capital flows to offset indebtedness and financial collapses by using democratic checks and balances that govern global values with productivity and accountability. |

||||||||

|

||||||||

| ||||||||

| . . as activity increases there's a flywheel effect that spreads out into other economies | ||||||||

| SME Cloudfunding | ||||||||

"The e2eCommerce is the operating platform of the Global Chamber of Economies - a totally new economic association or alliance that can respond to the real needs of the global social economic landscape - it has game changing processes that have the capability of addressing one important fundamental action required to grow economies but which is hindered by the establishment narrative . . and that is: SALES! - it's as simple as that! - Businesses need to make sales, consumers need the purchasing power to do so and taxes generated as a result need to get to the right places!! This is what grows economies and the platform is the answer!" Trading in economic growth is the new Open Market The overall economic infrastructure of e2eCommerce and Cloudfunding forms a new industry combining Commerce and Technology - ComTech - it encompasses all the mechanics of Commerce and adds new dynamics like Outsourced Selling, which fully monetizes the full selling prices of inventory, even before items are released to the market - to buyers who have the advantage of Price Demand, which allows the buying prices to cascade down to 20% of the full selling prices until a buyer buys at the price they want to pay, all without the seller ever needing to discount - then sales are completed with free payment exchanges from peer to peer, bypassing incumbents. Cloudfunding is fully accountable and auditable in real time, with the validation of all values verified continually both locally and globally - Cloudfunding separates Supply from Demand and operates both as individual open markets, giving both a greater incentive to generate growth - Cloudfunding changes the dynamics in the way Capital flows in Online Commerce ( and Offline ) by shifting Productivity to the leading position and distributes that value on a global scale - essentially decentralizing the value globally before applying a democratic global consensus of global users to help drive productivity into the local economies. e2eCommerce with Cloudfunding changes the game - it's no longer the Capital Investment into individual companies where dividends ( and share prices ) dilute the amount of value away from local communities, lowering economic growth by directing it to company shareholders - the game is now at the local economy's level where global users can be proactive in all the local economies by helping generate productivity across an economy's overall number of local industries, all tracked in real time via a Domestic Open Market Index - DOMIndex. e2eCommerce incorporates all sellers along the Supply Chains, with each seller being able to Outsource the Selling of their inventory and then have Price Demand available to a broader range of buyers to compete across the open markets, as for example the Dairy industry and Fruit Growers and their Supply Chains, which ultimately focuses on Localization - sellers gain control of pricing, while giving buyers a better buying experience with cascading buying prices. Proactive users will control economic growth e2eCommerce can also directly aim at utilities such as power where electricity bills can be commoditized into Smart Contacts to fit between the power company and the consumer - everyday costs like petrol/gas that fluctuate with global pricing, can be commoditized into the domestic market and avoid the global pricing manipulation for consumers, while creating continuous demand for the sellers, on a global scale - e2eCommerce is a new ecosystem that's built with technology to bypass the barriers setup on old legacy systems by incumbents, which offers little relief to consumers during this transition to the New Economy. This collaboration between local buyers and sellers automatically forms free open market economic zones - FOMEZs - which captures the industries linked to e2eCommerce where users are able to have real time data to help strategize, even forming local Co-Ops or Chambers to generate and drive their economy, and establish their position in the Global Chamber of Economies. Capturing the domestic economic growth in local economies brings a whole new perspective to economic productivity ( rather than speculatively trading shares in a business in the hope that those shares increase in value ) - with e2eCommerce users have economies that they can strategize with by proactively helping to drive the output of single Open Markets with the Outsourced Selling of products and services within an economy - and see it indexed in individual domestic markets on a global scale, in a new ecosystem where wealth is distributed in a linear trajectory for all global users to gain financially - this local economic change comes as most developed countries struggle to raise wages, all the while affordability for essential living costs continually increase at a greater rate to incomes. Cloudfunding offers 2 distinct advantages for the consumer - one is Price Demand Deals that gives the Buyer the opportunity to buy as low as 20% of the full selling prices - the other advantage is the Discount Deals that consumers can buy to build-up a discount range in their QwickPay account and have ready to use at sellers without hindering the seller's full selling prices - it means the demand can still be generated by the consumers, like when consumers go grocery shopping and have the discounts or catching a taxi ready on their mobile, all without the sellers even being aware, or hinder the seller from getting their full selling prices. | ||||||||

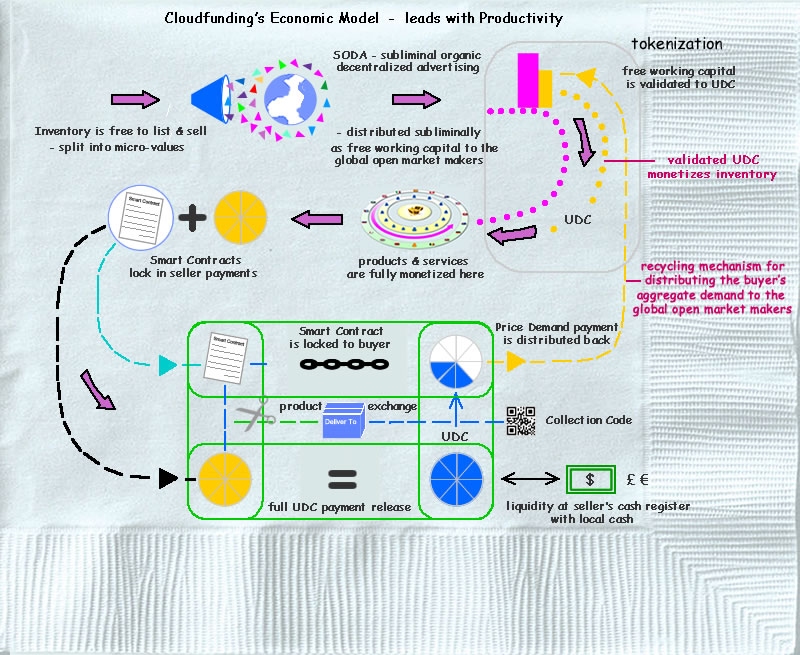

Here's a table napkin sketch of how it works  |

||||||||

Technology can move mountains Technology or the abuse of technology was to blame for the GFC but it could also be said that it was an inevitable outcome to the way economies have out-grown modern banking - which is to sell and distribute debt without the value ever being tied or governed to something tangible or productive - modern banking and economics is lead by Credit and Debt and that's why it will always boom and bust, and stable equilibrium will never be achieved. Cloudfunding reverses the centralized Money Supply flow lead by Credit - Credit/Debt > Distribution > Productivity . . . - to a decentralized Capital flow that's lead by Productivity - Productivity > Distribution > Free Capital |

||||||||

|

||||||||

The day of hand feeding societies through the Money Supply controlled by centralized systems is nearing the end of its cycle - for the sheer scale to operate in the new digital economy, and expand economies, it will only work effectively with decentralized neutral systems. The imbalances that constantly flow across economies causing losses in revenues, taxes and wages is turned back with Cloudfunding by bringing consistency in genuine economic growth - it challenges the status quo by shifting Technology directly towards a more balanced Commerce environment through fair and equitable trade, with exponential scale - rather than using scales of taxes and interest rates to try and stimulate markets to compensate losses in revenue and low wages Cloudfunding uses RingLink technology to open up the connections between economies to free up the seamless movement of a universal trading value around the world. That seamless movement between supply and demand is made possible when a product or service is processed using a proprietary bidding process that generates a Smart Contract, which can only be executed when it's released to a seller's local buyers, who then need to use Price Demand and be the first buyer to click 'Buy Now' as the price cascades down from the full selling price to as low as 20%, depending in the final winning bid price. |

||||||||

Scale matters Cloudfunding uses subliminal organic advertising, as one of the dynamics, to achieve global scale for what is the largest ever distribution of free Capital across the world - the money supply has been controlled by centralized systems for various reasons for many decades in the analogue world - but now technology has caught up and can expand exponentially with decentralized distribution systems to break down the barriers holding back financial inclusion for all. Unlike QE where the addition of printed money just simply diluted values and unevenly spread across economies, and has come back to distort global markets, bypassing the real economies - Cloudfunding is governed by genuine Productivity ( products and services ready to sell and validated on the completion of sale between buyers and sellers ) in all economies and markets. Cloudfunding operates in a new paradigm above B2B and B2C, it operates from economy to economy with e2eCommerce spanning across the world in a seamless flow of Supply and Demand between local and global Buyers and Sellers with Universally Decentralized Capital. Cloudfunding indelibly ties the value across all sovereign state currencies to generate a stable and neutral universal unit of value, which means the universal value is invariably backed by sovereign states through their currencies - this algorithmic economic infrastructure allows the constant validation with global currencies for e2eCommerce to operate on top of and across all the commercial activity from economy to economy - Direct Automated Market brings together all the commercial activity into one easy Market Index to follow trends in Productivity across industries and locations. While the e2eCommerce platform sits atop of the commercial activity within economies, it does so by allowing Capital flows to move freely and seamlessly between Sellers and Buyers, and between economies - what is uniquely technical and digital is that although the values being transferred are constantly validated as international trading units of account and are compared in real time with each of the global currencies, there are no fiat currencies held or transferred across borders. Cashless and decentralized The world is digital now and truly cashless, where the trust held in the sovereign states with the backing of their fiat currencies is extended down into the local economies where the trust is decentralized across the scale of interactions taking place in Productivity and Commerce. The hard currencies are held within the economies between Buyers and Sellers liquidating the universally distributed value with the fiat currencies - the Capital flows are further amplified with Direct Foreign Decentralized Capital that flows across borders stimulating local economies when Sellers use Outsourced Selling to attract free foreign Capital - this gives local economies the ability to control any trading surplus or deficit in real time. Liquidity from the universal value to the local fiat currency is tied to the products and services sales of local Sellers with constantly compared values, hence avoiding fees and charges to exchange universal value, eliminating exchanges and banks - the technology servicing the free peer to peer transfers and exchanges is supported within the economic infrastructure, and so avoids the need for fees or currency spreads that dilute values. Loans and lending is replaced by collecting the Free Economic Value flowing from the subliminal advertising - businesses and individuals can set up to collect the FEV and use the platform's tools to automatically build any size income stream for business or personal. Individuals can establish businesses as market makers, and businesses have use of a Digital Sales Division to expand their business sales and establish a new proactive department within the business to directly help drive sales - there's also Free Direct Backing for the businesses wanting to expand their footprint or for entrepreneurs looking to startup a new venture and need backing without losing equity. Local economies now have the upper hand with Localization Many local economies bear the brunt of global changes, whether that's from government policy, global trade or currency wars - the Digital Era has provided a unique opportunity to level the playing field for local Commerce. The internet has provided the means to distribute on a global scale as the world has seen with the scale of the online digital behemoths that have risen in the last two decades - that scale has come about predominantly from digital advertising. The change Cloudfunding provides is adding the missing economic infrastructure that was sidelined in the early Web 1.0 and again in the Web 2.0 mainly due to scale - that now changes with new Capital flows directly connected within browsers and mobiles of Users. Cloudfunding redirects the flow of Capital in the reverse to traditional Commerce and Advertising by applying e2eCommerce to supply a new economic value via Outsourced Selling and Subliminal Advertising, which is freely collected by Users from browsers and mobiles. Each product and service unit is individually commoditized and monetized when it is listed for Outsourced Selling - RingLink network is a visualization of how products and services are listed and distributed across thousands of rings - basically the value is decentralized as it moves from ring to ring or in effect from economy to economy. Local Commerce all along the Supply Chains, can now Outsource the Selling of any product or service, including locally produced and manufactured goods - Outsourced Selling changes the flow of Capital running within local economies by being able to access the free Direct Foreign Decentralized Capital. As local Sellers use Outsourced Selling, increased demand bought on by low buying prices increase the circulation of local cash and Universally Decentralized Capital, which effectively generates a real time ubiquitous flow of local productivity - it's Localization expanding into Free Open Market Economic Zones where productive Capital flows freely from economy to economy. FOMEZs are driven by OMMs operating as a neutral democratic global network of market makers that directly influences the local economies with Outsourced Selling and the communities of Users that benefit from the Direct Market to earn revenue streams from across the world. With local Commerce using Outsourced Selling there're numerous advantages that Sellers can benefit from, as well as receiving full 100% Selling Prices - there's the greater demand back along the Supply Chain that has deep benefits within the local economies. Local Producers and Manufacturers can dramatically reduce operating costs when taking advantage of other Suppliers and Utilities using Outsourced Selling to buy at lower prices, even paying local and global staff wages from Online sales revenue is free of fees. Subliminal Organically Decentralized Advertising ( free advertising ) and Outsourced Selling begin an economic flow of Commerce that fits the Digital Era - the transition of advertising, from being part of the mechanics of Commerce to its distribution as Free Economic Value - initially launching it as free working capital tied to genuine Global Productivity in the Supply and Demand of products and services - through to its final validation as a neutral Universally Decentralized Capital, key to the perpetual flow of economic growth in the New Economy. Outsourced Selling can be repeated continuously in a local region and provide enormous advantage for local Sellers, as Sellers join in, it establishes a natural Free Open Market Economic Zone - FOMEZ, taking local Productivity to a global scale with . . Free Open Market Economic Zones are what forms Localization inside the Global Chamber of Economies in the New Economy - from economy to economy, Cloudfunding distributes Subliminal Organically Decentralized Advertising to expose products and services from local Sellers so that Direct Foreign Decentralized Capital can be drawn back to inject new and free Capital into the local economy, exponentially speeding up trade for essential food to restaurants to real estate. Essentially what Cloudfunding does is what Central banks couldn't do - and that was to tie new Capital flows to tangible and intrinsic values that perpetually generates genuine value back into economies, without indebting any level of participant. Cloudfunding protects the local domestic manufacturing to retailing with Localization by operating on new Rails of Trade - where Supply meets Demand under new Rules of Engagement. |

|

|||||||

|

||||||||

|

||||||||

|

||||||||

|

||||||||

Outsourced Selling takes Local Commerce to a new level Traditionally when a product is sold between a country and another there's a transfer of money from the Buyer's country to the Seller's country, which's usually held within the international banking system, somewhere, these volumes exchanged between countries become part of a trade surplus and trade deficit system that's used to keep track of any imbalances. Trade Balances have a big effect on a country's financial ability to operate with sufficient money to support its operations. Cloudfunding challenges the status quo by changing the mechanics of payment for cross border commerce, - in all Outsourced Selling processes the payment for the full value of a product doesn't come from the country of the eventual Buyer, it comes from the local economy of the Seller, which is stimulated via the flow between local fiat currency and digital cash ( Ownership exchange ) during local commerce. . . the 'Ownership' is the paradigm shift from being part of a monetary system and moving to a scalable economic system . . this shift changes the dynamics of how global commerce and trade payments move freely from economy to economy . . it changes the economic outcome of local economies by eliminating the costs incurred with old world incumbents The mechanics of Outsourced Selling generates Capital for the Seller's economy, with the Global Crowd strategies drawing in digital cash ( money ) into the local economy via the deep algorithmic economics built into the system - Global Productivity. On a larger scale with foreign Capital Investment ( FDI ) coming into a region, when Outsourced Selling is used by a region's local industries and Sellers it can scale to any size to draw in free foreign Capital ( without the costs or loss of control over assets ), there's an automatic Direct Foreign Decentralized Capital ( DFDC ) that transfers to the region's local economy, without any transfer of money ( foreign exchange ) being involved - the activity generated in the local productivity creates the validation. The unique effect that Outsourced Selling does is it generates velocity of the local currency using the full prices of any product / service sold, which also generates the maximum tax revenue for the local governments. While a Buyer may be in another country where a payment is paid via digital trading cash there is no transfer or exit of fiat currency from the Buyer's country as it does in traditional trading, when a Buyer pays for the product using Universally Decentralized Capital by initially using Pay It Forward, Now!, it helps to raise the velocity of the local fiat currency in the Buyer's local economy. The outcome is much better for the Buyer's country with no cross border currency transfer and an even better outcome for the Seller's country with full payment that's not diluted by incumbents taking a percentage of any currency transfer. Sellers often look for loyal customers to form a consistent revenue base, the Platform provides Sellers with 'long tail' connection with customer activity across the world, it means that a Seller can initially invite a customer to the Platform to bid and buy from the Seller, - the long tail is the commerce activity that a customer does in the local region and anywhere else around the world with other Sellers on the Platform, the Seller silently earns a % of the commerce forever with each customer. - the number of customers invited to the Platform reflects in the growth earnings for the Seller - see Queen Bee. |

||||||||

|

||||||||

| Sellers can Sign-up for early access We're opening up to Sellers early - so if your business wants to gain the advantage, please add your details |

||||||||

|

|

||||||||

| Home | Products | Services | Buyer Posts | Seller Posts | ||||||||

Check out a Deal Registration and Cloudfund Strategy See a Snap-Shot view of a Cloudfund strategy and bidding for Deals Cloudfunding generates Price Demand - digitizes 'cash' to flow ubiquitously around the world What's The Monetizing Moment? Cloud Commerce operates by Outsourcing the Selling to the Crowd by Cloudfunding How Sellers Outsource their Selling to the Crowd? |

||||||||

As UDC is validated and exchanged in the Digital Economy it permeates out into local economies! see the connection of players that help achieve 'Productivity' : Global Cloud Productivity Wherever your Location is - you are not alone! - this is the 'RunWay' we're now on, with the New Economy! |

||||||||

| About Us Contact Privacy Policy Terms of Service |

||||||||